Trailing stop order example forex

The credit card offers that appear on this site are from credit card companies from which MoneyCrashers. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear on category pages.

Advertiser partners include American Express, U. Bank, and Barclaycard, among others. One of the most difficult decisions investors have to make is when to take profits and when to cut losses short. Some traders will prematurely sell as a stock rises while others will hang onto their shares far too long as prices plummet. How can you prevent from making the latter mistake? The trailing stop-loss order is one tool that can help you trade with discipline.

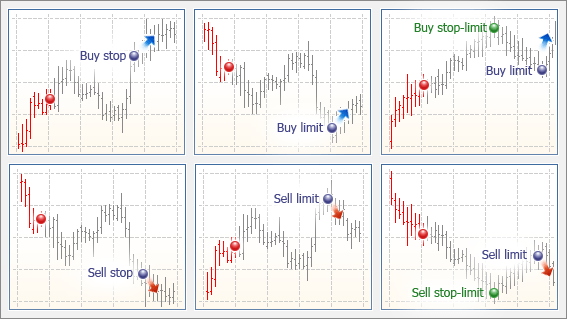

The trailing stop-loss order is actually a combination of two concepts. A stop-loss order is when you specify a certain action to be taken at a certain price.

You can set a stop-loss order at any value. Essentially, a stop-loss order is a form of investment risk management. The problem with stop-loss orders is their lack of adaptability; they are static and do not move.

Trailing Stop Orders | Interactive Brokers

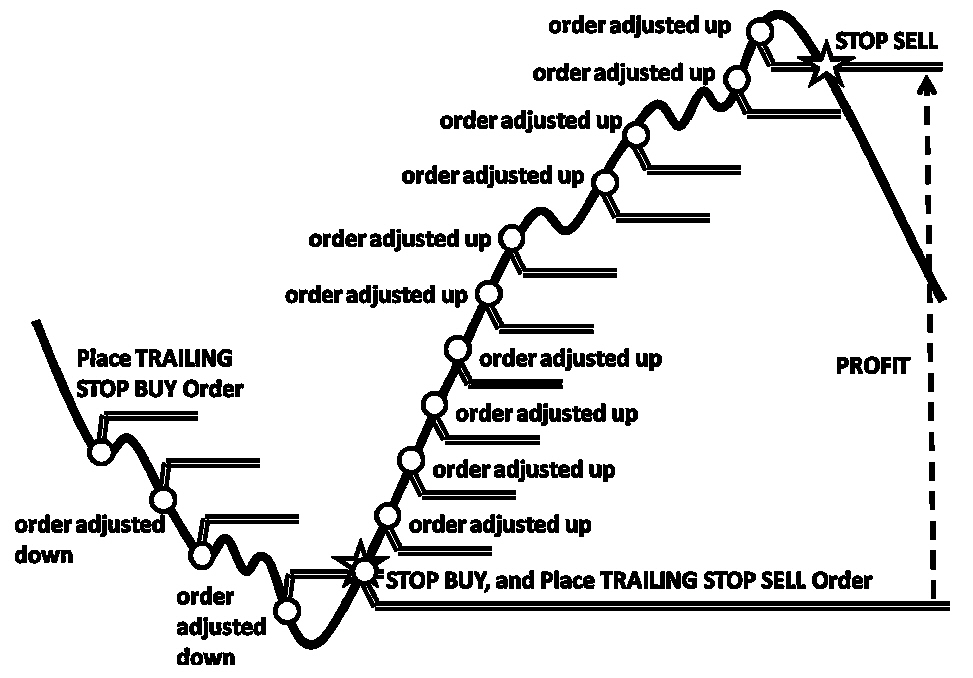

The trailing stop-loss order adds in a dynamic component to overcome this hurdle. With the trailing feature, the stop-loss order is no longer fixed, but rather trails the price by a certain amount usually a set percentage that you specify. In doing so, one of the key advantages of the trailing stop-loss order is that it allows you to lock in profits rather than hold on to a stock for too long only to see your profits disappear.

One of the keys to a successful trailing stop-loss order is making sure to analyze the specific stock and its historical volatility. Another thing to keep in mind is that while the trailing stop-loss order price will automatically rise with share prices, it will never decrease. Trailing Stop-Loss Example You purchase shares of Xerox Corporation NYSE: But as the shares of Xerox rise, so does your trailing stop-loss. The trailing stop-loss order is an effective tool, when used wisely, and it can help you gracefully liquidate government making money warband position trailing stop order example forex either a profit or a limited loss.

Before setting your order, make sure you take into consideration the overall volatility of the market and the stock, and whether you would like to be a short or long-term investor in the company. Have you traded with trailing stop-loss orders in the past? What has your experience been like? In what situations do you feel these orders are most valuable? Kurtis Hemmerling is a personal finance enthusiast that has been putting his passion into writing since His goal current exchange rate gbp to canadian dollar to demystify the investment world to benefit the readership of Money Crashers.

Sign up below to get the free Money Crashers email newsletter!

The content on MoneyCrashers. Should you need such advice, consult a licensed financial or tax advisor.

Trading Forex with a Trailing Stop

References to products, trailing stop order example forex, and rates from third party sites often change. While we do our best to keep these updated, numbers stated on this site may differ from actual numbers. We may have financial relationships with some of the companies mentioned on this website.

We strive to write accurate and genuine reviews and articles, and all views and opinions expressed are solely those of the authors. About Press Contact Write For Us. Money Crashers Topics Banking Bank Account Promotions Free Checking Accounts Credit Cards Cash Back Credit Cards Low-APR Credit Cards Travel Rewards Credit Cards Hotel Credit Cards Gas Credit Cards Student Credit Cards Business Credit Cards Secured Credit Cards More About About Us Press Contact Write For Us Top Personal Finance Blogs Time Banking Hard earned cash meaning — How to Trade Services With a Time-Based Currency.

Spend More for High Quality or Buy Cheap to Save Money? Share 10 Tweet Pin 2 Commodity traders futures commission 9.

Trailing Stop-Loss Order The trailing stop-loss order is actually a combination of two concepts. Of course, you can set the value to any amount you like. This order does not put a cap on profits. Shares can continue to rise and you will stay invested as long as prices do not dip by your predetermined percentage. The trailing stop-loss order is flexible. You can enter any trailing stop-loss percent for a customized risk management plan and change it as you please.

There is no cost to placing a stop-loss order. This order allows investors to take emotions out of their trades and instead stick to predetermined goals. Disadvantages There is no guarantee you will receive the price of your stop-loss order. If the stock price drops quickly, your order may not get filled at your predetermined stop price.

Thus, you may be forced to sell at a lower price than you expected.

This is particularly true with illiquid stocks or in fast-moving markets. Some brokers will not allow for stop-loss orders for specific stocks or exchange-traded funds ETFs. Extremely volatile stocks are difficult to trade with trailing stop-loss orders. If you set an order too low to account for these potential fluctuations, you are liable for significant losses.

But if you set the order too high, you may end up unwillingly selling the stock due to normal daily price movements at a time when you might be better off holding onto the stock. You lose the ability to make a thoughtful and analytical decision whether to sell the stock after a price drop when you might otherwise deem the drop irrational.

Final Word The trailing stop-loss order is an effective tool, when used wisely, and it can help you gracefully liquidate a position with either a profit or a limited loss. Investment Risk Management Strategies - 5 Ways to Play Defense. JoinSubscribers Sign up below to get the free Money Crashers email newsletter! Read More from Money Crashers Lifestyle Time Banking Explained — How to Trade Services With a Time-Based Currency. Lifestyle 9 Everyday Carry Items You Need to Have to Be Prepared for Anything.

Shopping Spend More for High Quality or Buy Cheap to Save Money? Share this Article Friend's Email Address Your Name Your Email Address Comments Send Email Email sent!