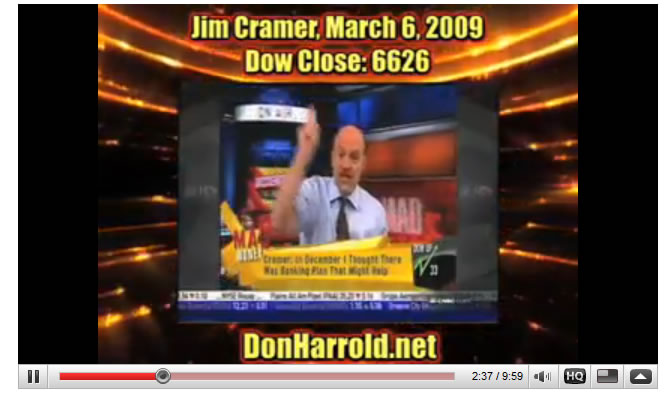

Cramer stock market bottom

Let it be duly noted after today that the grocery business has become no better than the department store as a place to invest.

That's right after the horrendous forecast cut by the largest food chain in the country, Kroger KR , we have officially come to still one more un-investible space in the retail business.

Nvidia Is the Key to the Stock Market Right Now, Jim Cramer Reveals - TheStreet

I don't want to blame Kroger for its ills. It's a fantastic company, the best at what it does.

Cramer's 'Mad Money' Recap: Spotting Tops and Bottoms - TheStreet

I love shopping at their Fred Meyer stores. They are clean and bright and offer fantastic values, particularly with their private-label brands. But after listening to today's conference call, one can only conclude that supermarkets are in one gigantic race to the bottom and no one will be unscathed, perhaps least of all Kroger.

How bad is it? There was a time when Kroger would deliver a consistent same-store-sales number that led the industry. This past quarter, same-store sales excluding fuel fell 0. But after that, the news was all bad. To start, there was labor inflation and food deflation, never a good combination. The Kroger conference call, which used to be full of idolatry for the Cincinnati masters, this time was almost like an open rebellion.

Over and over they were peppered with questions about how they were going to fend off Walmart WMT and Amazon AMZN and other competitors and not a single questioner seemed satisfied. Worse, at one point they simply seemed to give up and agree.

I think that's an understatement. This business has always had razor-thin margins when there were only traditional players in the game.

But then, a few years back, Costco COST decided to emphasize food above all other areas and pretty much decided it was willing to lose money at it and make it back on the membership. Whole Foods WFM decided to go the other way and cherry-pick the wealthier shopper.

Trader Joe's then arrived and went after all sorts of demographics. Then Walmart and Target TGT decided they had to offer food, and while initially both seemed off their game, they rapidly realized there was only one way to compete: Not to be left out, the dollar stores, buoyed by the opportunity to take advantage of customers with food stamps, moved all in to the segment.

At the same time, the two biggest drugstore chains, CVS Health CVS and Walgreens WBA , decided they were losing out if they weren't into food. Walgreens is part of TheStreet's Action Alerts PLUS portfolio. Then Amazon decided to try its hand at the non-food segment of the grocery store, which is often the most lucrative, and now we know it is making noises and inroads in food, too.

Finally, last straw, two German outfits, Aldi and Lidl, have just declared open season on American grocery chains, moving in with aggressive plans to take on all comers. They, too, are chains that will compete on price. How fitting that Kroger reported on the day that Lidl hit the beach with stores opening today in Virginia, North Carolina and South Carolina.

There is no way Kroger is going to cede its turf to everyone. Sadly, I think Kroger knows it. There was a resigned nature to this call that makes me say, "Call me back when somebody blinks. Action Alerts PLUS , which Cramer co-manages as a charitable trust, is long WBA. Portfolio Manager Jim Cramer and the AAP Team reveal their investment tactics while giving advanced notice before every trade.

All of Real Money , plus 15 more of Wall Street's sharpest minds delivering actionable trading ideas, a comprehensive look at the market, and fundamental and technical analysis.

The SU10 Team uncovers low dollar stocks with serious upside potential that are flying under Wall Street's radar. With Top Stocks, Helene Meisler uses short and long-term indicators to pinpoint imminent breakouts in stocks.

Your browser is not supported. Please upgrade to one of the following browsers: By Jim Cramer Follow. Stock quotes in this article: Then there was a pledge that they were not going to lose customers or share going forward.

Get an email alert each time I write an article for Real Money. More From Jim Cramer Cramer: Someone Has Created a Monster ETF Cramer: Do We Have to Listen to Bonds? Is This the 'Big Give-Up' on Oil? Columnist Conversations Robert Lang:. Big momentum shift here to biotechs for now. We'll take this one down before earnings SOLD FDX JUL CALL AT 6. Rolling Down AAOI, XLNX. The market is set to open just a bit lower this morning. This should be expected, given the dear REAL MONEY'S BEST IDEAS.

Select the service that's right for you! Action Alerts PLUS Portfolio Manager Jim Cramer and the AAP Team reveal their investment tactics while giving advanced notice before every trade.

Real Money Pro All of Real Money , plus 15 more of Wall Street's sharpest minds delivering actionable trading ideas, a comprehensive look at the market, and fundamental and technical analysis.

BlueChipPennyStocks - The number one trusted financial newsletter site

Model portfolio Trade alerts Recommendations for over 4, stocks Unlimited research reports on your favorite stocks. Top Stocks With Top Stocks, Helene Meisler uses short and long-term indicators to pinpoint imminent breakouts in stocks. Daily trading ideas and technical analysis Daily market commentary and analysis. Except as otherwise indicated, quotes are delayed. Quotes delayed at least 20 minutes for all exchanges.

Market Data provided by Interactive Data. Company fundamental data provided by Morningstar. Earnings and ratings provided by Zacks. Mutual fund data provided by Valueline. ETF data provided by Lipper.

Cramer: Supermarkets Are in a Race to the Bottom

Powered and implemented by Interactive Data Managed Solutions. TheStreet Ratings updates stock ratings daily. However, if no rating change occurs, the data on this page does not update. The data does update after 90 days if no rating change occurs within that time period. IDC calculates the Market Cap for the basic symbol to include common shares only. Year-to-date mutual fund returns are calculated on a monthly basis by Value Line and posted mid-month.

About Privacy Policy Terms of Use Careers Customer Service Advertise With Us.