Calculate price call option

September 10, by m slabinski.

Depending on the position, this might mean the highest the underlying can be with short calls , or the lowest the underlying can be with short puts , or both with short strangles. For long options, the breakeven point is the debit paid past the long option strike price.

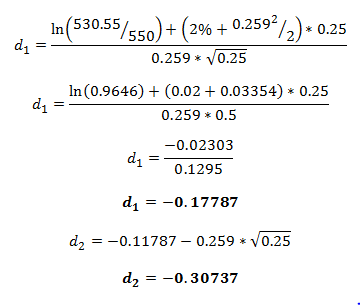

Understanding Option Pricing

The easiest way to think about this is that when we buy something, we must sell it for the same amount we bought it for to break-even. The only way we can do that at expiration for long options is if the strike price is ITM by the same value that we bought the option for, since we only have intrinsic value at expiration.

For this to happen, the stock needs to move in our favor. For short options, the breakeven point is calculated as the credit received ITM past the short option strike price. Notice that the breakeven point, whether we are long or short the position, is the same.

The profit and loss areas are opposite, depending if we are long or short, but when the trade makes no money breakeven , both the buyer and seller make no money. This makes sense if you picture yourself as buying or selling one of the positions.

If you make money on the trade, then the person you traded with will have lost the same amount of money you made profit and loss areas are opposite if you are long or short. If you breakeven on the trade, making no profit and no loss, then the person you traded with will have also broken even and made no money making the breakeven point the same for both buyer and seller.

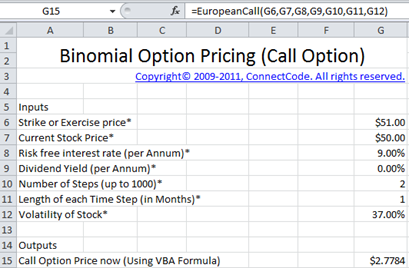

Option Price Calculator

The most important concept to grasp is that with long options, the breakeven will always be against us, and with short options, the breakeven will always be for us.

The breakeven acts as a buffer for our profit if we are short options, and the breakeven serves as a minimum movement mark for long options. When making trades on the curve page, the most apparent way to see your breakeven points is where the red and green loss zones start.

At tastytrade and dough, we tend to sell premium extrinsic value with high implied volatility rank IVR to increase our probability of profiting on trades. Depending on the trade strategy, a trade could have one or multiple breakeven points.

What is the value of a call or put option? | Calculators by CalcXML

The breakeven point for a trade will be the same regardless of being long or short the position the debit paid is the same amount as the credit received , which is why it might help option sellers and hinder option buyers. Still have questions about break-even prices? Email us at support dough. Follow the election through one of the largest, most liquid, and predictive markets in the world.

Beginner intermediate Blog Sign Up Login. Options Breakeven Price How To Calculate Breakeven. Long Options For long options, the breakeven point is the debit paid past the long option strike price.

Where to Find Breakeven Prices in dough dough makes keeping track of your breakeven prices really easy. Liquidity Is Still King. Trump may be president, but liquidity is still king. Oct 14, beginner , trading strategy , bearish , cost basis , expiration , puts , rolling , short , stocks m slabinski Comment.