Stock option ifrs vs gaap

White paper from the accountancy notes sharper net-earnings reductions than under U. GAAP — and more tax-rate volatility.

IFRS VS U.S. GAAP DemystifiedDifferences in the tax-benefit information that International Financial Reporting Standards require in the case of employee stock options could be challenging for companies, according to a new report from PricewaterhouseCoopers. In a white paper authored by a U. PwC partner and a director in the Brussels office who is in the U.

GAAP vs. IFRS - ywegyrayeku.web.fc2.com

While the report noted that both GAAP and IFRS require companies to expense employee stock option awards based on the fair value of the option on the grant date, PwC noted that IFRS bases tax benefits on the estimated future tax deduction on the reporting date. The Big Four accounting firms all have become more aggressive in the past year in producing reports about issues related to IFRS, and in planning educational programs for clients and others.

Your email address will not be published. Conferences Webcasts Research White Papers Jobs Training Newsletters Magazine Search for: CFOs Still Spurning High-Return Projects Despite the overall lower cost of capital, the….

PCAOB Auditor Pressure Spurs Sarbox Controls Tightening Increasing Public Company Accounting Oversight…. July 21, CFO.

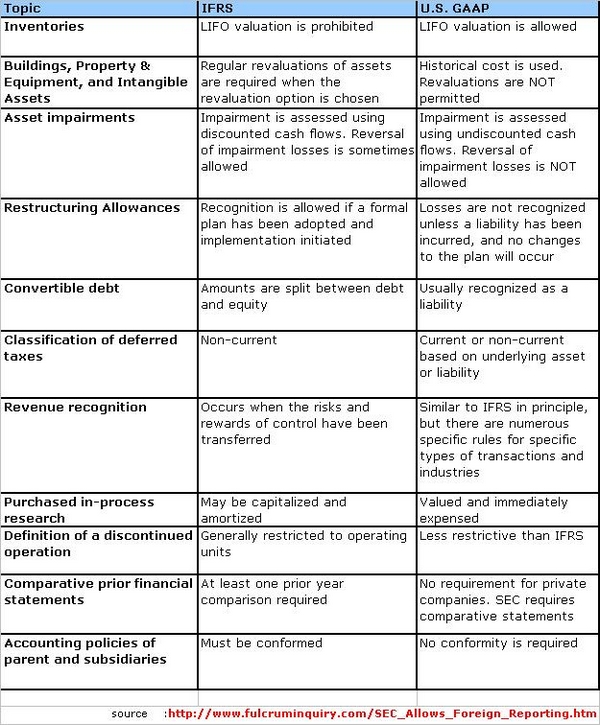

What are some of the key differences between IFRS and U.S. GAAP?

When Will GAAP Merge with IFRS? Companies Cozying Up to IFRS PwC Sees Revenue Recognition Snags in IFRS. Leave a Reply Cancel reply Your email address will not be published.

Forbidden

Videos Whitepapers Research Magazine. Conferences Argyle Events Webcasts.

Reprints Back Issues Mobile Widgets RSS. About CFO Editorial Staff Press Advertise FAQ Contact Us. Relax and unplug with our award-winning coverage.