Foreign exchange gain loss accounting treatment

Can't find your country listed? Please visit our global website instead.

Foreign currency monetary items are retranslated at balance sheet date exchange rate. Non-monetary items are carried at historic exchange rate.

Exchange gains and losses are recognised in profit or loss. SSAP 20 permits transactions covered by a forward contract to be translated at the contract rate. Foreign currency monetary items are subsequently translated in the functional currency at the exchange rate applicable at the end of the reporting period.

Non-monetary items are carried at the historic rate and non-monetary items measured at fair value are translated at the rate of the date when the fair value is re-measured. Exchange differences on monetary items are recognised in profit or loss. Exchange gains or losses on non-monetary items measured at fair value are recognised as part of the change in fair value posted in other comprehensive income or profit or loss. FRS does not include provisions about using a contracted exchange rate to match a trading transaction.

Therefore balances covered by a forward contract will be retranslated at the year-end rate. In turn under FRS a foreign exchange forward contract will be recognised in the balance sheet as a financial instrument at fair value through profit or loss.

What is Journal Entry For Foreign Currency Transactions? | Accounting, Financial, Tax

However, FRS allows designating a foreign exchange forward contract as a hedging instrument in a designated relationship to hedge the foreign exchange risk of a trading transaction. In such a case the change in the fair value of the forward contract will be recognised in other comprehensive income to the extent that it effectively offsets the retranslation gain or loss on the expected cash flows from the trading transaction.

The option of adopting hedge accounting is, however, onerous in terms of documentation, complexity of the rules and disclosures and it is unlikely to be attractive for many entities. To do so all the items expressed in its functional currency should be translated in the presentation currency of choice.

Assets and liabilities should be translated at the closing rate at the end of the reporting period while income and expenses shall be translated at the exchange rates at the day of transactions.

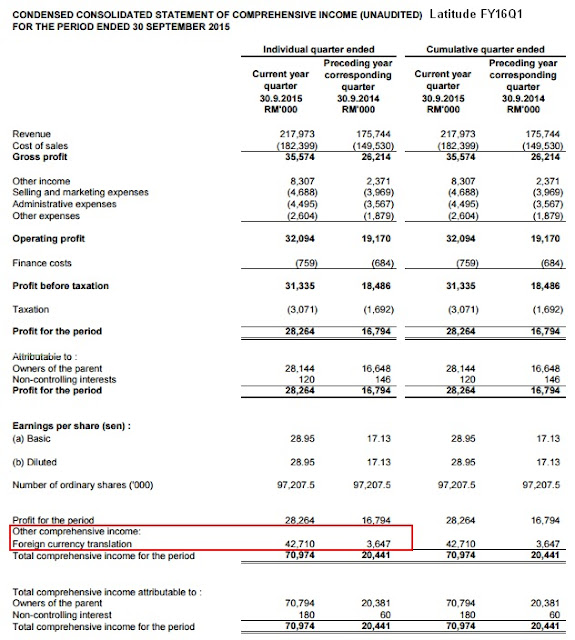

Exchange differences resulting from the translation of financial statements in functional currency to presentation currency are recognised in other comprehensive income.

The transition section of the standard is silent on the treatment of foreign currency translations and accordingly the general transitional procedures in FRS will apply on first-time adoption, ie assets and liabilities will be recognised, reclassified and measured as at the transition date in accordance with FRS In particular switching to financial statements presented in a currency other than Sterling may need to be agreed with lenders and would need to be verified against any restrictive covenants.

Such variations may affect not only debt covenants but also remuneration and share based schemes that may have been originally stipulated by reference to local currency and that would need to be revisited to take into account any foreign exchange distortion. For entities using forward foreign exchange contracts to match their commercial transactions, the changes in FRS result in a more exacting financial reporting treatment.

Such entities would have, under SSAP 20, reduced their exposure to volatility in the profit and loss account by using the exchange rates specified in the forward contracts.

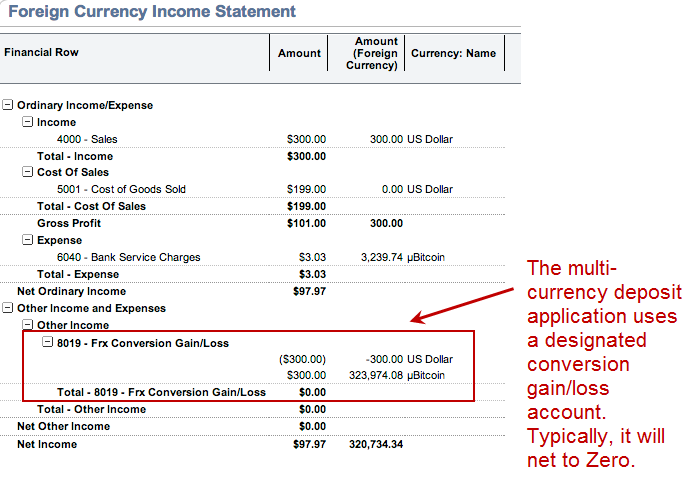

illustration entries for currency exchange gains and losses

Under FRS , in order to achieve an element of matching foreign exchange gains and losses on their commercial transactions, entities may choose to apply hedge accounting to such arrangements in accordance with Section 12 of the standard. However, it is likely that entities may decide not to adopt hedge accounting because the administrative burden of maintaining the relevant documentation and the intrinsic complexities of hedge accounting may outweigh the benefits of the accounting treatment permitted.

Entities not opting to apply hedge accounting will, however, need to recognise forward foreign exchange contracts at fair value when they are taken out and will recognise fair value gains and losses in profit or loss on an on-going basis at each reporting date rather than just at the time of settlement.

illustration entries for currency exchange gains and losses

On the other hand, transactions and monetary items covered by forward contracts will be translated at the exchange rate of the transaction date and of the year end respectively with exchange differences recognised in profit or loss. Effectively this treatment will produce two sets of entries in profit or loss, while under SSAP 20 there would have been none. Profits and losses arising to the company from its derivative and related contracts include exchange gains and losses.

The exception to this is a gain or loss on a derivative that consists wholly or mainly of currency.

Where a company prepares its accounts in accordance with UK GAAP excluding FRS23 and 26 and uses a forward currency contract to match its exchange exposure, the exchange movements arising in respect of the forward currency contract that are eligible for matching are determined by reference to the spot rate prevailing at the end of the accounting period.

It is no longer possible for profits and losses on forward currency contracts to be left out of account. ACCA - Think Ahead. Home Our qualifications Intermediate with Foundation Diploma Apply to become an ACCA student Why choose to study ACCA? ACCA Accountancy Qualifications Getting started with ACCA Careers in accountancy Register your interest in ACCA Partnerships With Universities - Pakistan Employers Approved Employer programme ACCA Careers Job Board Why choose ACCA qualifications?

ACCA important dates and fees Getting started with ACCA Testimonials Your ACCA members and their CPD Support for ACCA trainees Qualifications for your business Learning providers ACCA Approved Learning Partners Tuition resources Computer-Based Exam CBE centres Content providers Registered Learning Partners Exemption accreditation University partnership programme: Accelerate Members Your membership CPD for members Member networks AB magazine: International edition Sectors, industries and roles Professional standards and ethics Council and elections Annual General Meeting AGM Professional accountants - the future The ACCA and CA ANZ alliance Find an accountant Students Exam changes Getting started with ACCA Your study options Exam support resources Exam entry and administration Practical Experience Ethics Student Accountant Support for students in Pakistan Professional insights An introduction to professional insights Global economics Professional accountants - the future Risk Supporting the global profession Technology Meet the team.

The global body for professional accountants. United Kingdom Scotland Wales Ireland Armenia Azerbaijan Belarus Czech Republic Estonia Georgia Hungary Latvia Lithuania Poland Russia Slovakia Ukraine.

United Arab Emirates Oman Bahrain Kuwait Saudi Arabia Egypt Jordan Iran Yemen State of Palestine Iraq Lebanon Syrian Arab Republic. Nigeria South Africa Zambia Zimbabwe. Australia China Hong Kong India Malaysia New Zealand Pakistan Singapore Sri Lanka Vietnam.

Understanding the treatment of foreign currency under FRS Transition The transition section of the standard is silent on the treatment of foreign currency translations and accordingly the general transitional procedures in FRS will apply on first-time adoption, ie assets and liabilities will be recognised, reclassified and measured as at the transition date in accordance with FRS Taxation impact of the changes Profits and losses arising to the company from its derivative and related contracts include exchange gains and losses.

How to Record All Transactions in Foreign Currency in ywegyrayeku.web.fc2.com 9Corporate reporting; Financial reporting; UKGAAP. ACCA ON THE WEB ACCA Mail ACCA Careers ACCA Blogs ACCA Learning Community Your Future USEFUL LINKS Our qualifications ACCA-X online courses Find an accountant ACCA Rulebook News MOST POPULAR myACCA ACCA Qualification Member events and CPD Work for us Past exam papers. ACCA Mail Login to ACCA mail.